Top 14 Countries With The Lowest Tax Rate In The World: Taxes and death are reportedly the only two certainties in life. The world’s lowest income tax nations can offer a higher standard of living, despite the fact that this may be true for spreadsheet dictators with pathological addictions to spray-on suit trousers. Nobody really wants to see significant portions of their money taken away by the government.

The thought of uprooting and starting over on a remote island with a few coconut trees and no income tax is so alluring because of this. Sounds like the fast track to retirement, doesn’t it? Sun, beach, sangria, and a full paycheck with no taxes? We examine a few nations with low or no income taxes.

Recommended: Biggest law firm in Kenya

Top 16 Countries With The Lowest Tax Rate In The World 2024

1. United Arab Emirates: For one very excellent reason, the United Arab Emirates is at the top of our list: neither a personal income tax nor a corporate income tax are enforced there.

A large part of this is attributable to the country’s enormous oil and gas earnings. In 2018, the nation did adopt a new 5% value-added tax, which brought in Dh 25 billion, or around $7.3 billion USD at the current currency rate. Just 0.96% of the UAE GDP was made up of tax receipts overall.

2. Myanmar: Myanmar has a rather high top personal tax rate of 25% for a nation with minimal taxes. On the other hand, employee social security taxes are just 2%, and the tax take as a proportion of GDP is a pitiful 5.81%.

The nation, once known as Burma, is still working to overcome its totalitarian history; its first free elections were just held in 2015. The country has been severely affected by the coronavirus pandemic, yet previous to the outbreak, 6.3% economic growth was predicted for fiscal year 2019–20.

Also see: What To Do If You Are Stopped By The Police

3. Cyprus: The corporation tax rate in Cyprus is among the lowest in Europe, at just 12.5% for resident businesses, while there is no taxation for non-resident businesses. People who are tax residents are subject to income tax on their worldwide income, whereas non-tax residents are only subject to tax on their income earned in Cyprus.

Tax residents must pay 20% tax on income above 19,500 euros, up to 35% for incomes exceeding 60,000 euros. In Cyprus, workers contribute 7.8% of their salaries, while the company contributes 11.5%. The regular VAT rate is 19%, although there is a reduced rate of 9% for food, books, and lodging. Rent, exports, and financial services are all free from VAT.

4. Ethiopia: Although Ethiopia’s top personal income tax rate is 35%, overall tax receipts only account for 6.66% of GDP. Ethiopia boasts some of the greatest income equality in the world despite frequently being cited as one of the world’s poorest countries, which it still is.

The poverty rate in Ethiopia has significantly decreased from 44% in 2000 to 24% by 2016. The Ethiopian economy has likewise seen rapid growth for many years. The government actively participates in Ethiopia’s economy, injecting funds through infrastructure and other initiatives.

Also see: Countries with the best education system in the world 2024

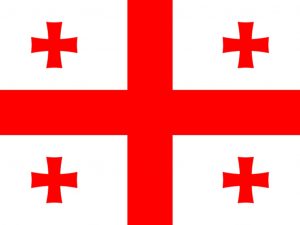

5. Republic of Georgia: Georgia generally has a territorial tax structure that excludes income received elsewhere. Consequently, it is a desirable location for anyone with a Georgian residence who receives income from sources outside of the country because Georgia will not tax the earnings. The income tax is merely 1% of income up to 500,000 Georgian Lari, or around $145,00, and there are few other taxes.

For money earned outside of Georgia or from reselling cryptocurrency, there is no personal income tax. Corporate tax is 15% once dividends are paid, and there is no tax if the money is reinvested. Technology businesses that offer services outside of Georgia are exempt from paying taxes, and there are “free industrial zones” inside Georgia that offer similar benefits.

6. Argentina: The top personal income tax rate in Argentina is 35%, and the country’s high indirect tax rate is 21%. However, taxes as a proportion of GDP are just 8.04%. With one of the largest economies in Latin America, Argentina mostly depends on its abundant energy and agricultural resources. The economy is presently working to exit crisis mode, nevertheless.

The COVID-19 epidemic has inflicted a further blow after contending with severe economic hardship for two years. Argentina’s GDP dropped by an astounding 16.2% in the second quarter of 2020, the largest contraction in the country’s history.

Recommended: Advantages and Disadvantages of Fascism

7. Luxembourg: Firms, especially big businesses, may operate tax efficiently in Luxembourg. Many corporations’ dividends are not taxed in Luxembourg, nor are capital gains if the shareholder owns less than 10% of the business. Holding corporations benefit from favorable conditions that allow for international trading with cheap taxes. In addition to the standard corporation tax rate of 17%, there is a municipal business tax of 6.75% and a payment to an employment fund of 1.19%.

Numerous multinational firms, like Pepsi, Amazon, and Apple, maintain subsidiaries in Luxembourg that benefit from advantageous tax laws. Corporations that are residents of the nation are solely subject to local taxes; non-resident companies are subject to worldwide taxes.

8. Lichtenstein: Lichtenstein offers one of Europe’s lowest corporate tax rates, at around12.5%, as well as favorable incorporation procedures and tax incentives, making it an appealing venue for people to create holding corporations. For individuals making over 200,000 CHF($219,00), or 8% of gross income, income tax is little. The level of income tax can, however, be increased by a few surtaxes.

A wealth tax of 4% on the fair market value of assets and a tax on any charitable gifts that would have otherwise lowered the amount of wealth tax paid are the other relatively low taxes, with the VAT at 7.7%, real estate capital gains tax at 3% to 4%, and wealth tax at 4%. The sale of stock in domestic or foreign firms does not result in capital gains tax, estate, gift, or inheritance taxes.

Also see: Tools for economic analysis

9. Malta: While Maltese citizens pay a top rate of 35% for the highest earners, Malta has a flat rate income tax of 15% on most sources of income for foreign nationals. The corporate tax rate for foreign-owned businesses can be reduced to just 5% by receiving a refund of 30% of the 35% corporation tax.

On capital gains and dividends received from non-resident entities, holding companies do not have to pay corporate tax. Maltese citizens are exempt from paying taxes on foreign capital gains even if the income enters Malta and is not brought into the country.

10. Saudi Arabia: Saudi Arabia is among the few nations without a personal income tax in the world, while it does impose a 10% social security tax and 15% in indirect taxes. Even still, in 2020, this nation with its abundant oil has struggled.

A value-added tax of 5% was imposed on the country in 2018 due to declining oil earnings, and that tax was tripled to 15% in 2020 as a result of the economic turmoil brought on by the coronavirus epidemic. The Kingdom’s tax income may surpass the current 8.93% of GDP if things keep getting worse.

Recommended: Countries With The Best Healthcare System 2024

11. Andorra

Tax rate: 10%

With 20,000 people, Andorra is regarded as one of the safest countries in the world. There are several tax havens that display the best in beachfront life, but for those who would rather have snow than sun, there is Andorra, a charming tiny nation situated in the Pyrenees mountains, split between France and Spain.

Although it is not a totally tax-free haven—those making over 40,000 euros annually must pay 10% tax—it does have a very low ceiling on the tax rate. As a result, you’ll spend less time evading taxes and more time hitting the slopes. If skiing is not your thing, the neighborhood is renowned for being calm and laid-back. Although Catalan is the official language, people also frequently speak Spanish, Portuguese, and French.

Also see: Richest Pastors In The World And Their Networth

12. Belize

Tax rate: 25%

Belize can be the tropical paradise to call home if Bermuda or the Bahamas are out of your price range. Belize is one of the less expensive Caribbean getaways that may be categorized as a tax haven, with a cost of living that is around two-thirds that of the aforementioned B-locales. To begin with, taxes are reasonable.

Individuals and businesses are subject to a 25% income tax threshold, with the first US$10,000 being excluded. Additionally, there are no capital gains taxes and property taxes are calculated at 1% to 1.5% of the land’s value. Any offshore corporation that excludes revenue from the US is considered a Belize International Business Corporation, and its dividends are thus not subject to tax. Additionally, there is no inheritance tax.

Recommended: Most Dangerous People In the World

12. The Cayman Islands

Tax rate: Zero percent

The Cayman Islands have come to be associated with foreign investors and multinational businesses seeking tax havens. It is one of the greatest tax-free nations for enterprises, with a corporate income tax rate of zero in addition to a zero percent income tax rate. The Cayman Islands are home to some of the most well-known foreign banks, and businesses there must pay a licencing charge, which helps to support the local economy.

Due to the country’s attractive tax structure, investors and multinational corporations have been able to rapidly enhance their wealth while also protecting it through the well-organized and controlled banking system. Living in the Cayman Islands offers access to outstanding standards in a variety of areas, including healthcare, education, infrastructure, and the immaculate preservation of the surrounding natural environment, even though there may be a cost factor to take into account.

14. Bulgaria

Tax rate: Ten percent

Due to its uniformly decreased tax rates, Bulgaria has developed a reputation as a nation with cheap taxes, drawing people wishing to live in one of Europe’s tax-friendly nations. Bulgaria boasts one of the lowest tax rates of any European nation, with a flat ten percent income tax rate on both personal and corporate income.

Due to its favourable tax structure, the nation has gained a reputation as a desirable location for businesspeople, investors, and digital nomads. Further adding to Bulgaria’s attraction is the absence of wealth or inheritance taxes. Bulgaria is a desirable option for anyone wishing to maximise their finances while taking advantage of residing in a European Union member state because of its low tax burden and competitive business prices.

Recommended: Countries with the Best Doctors in the World

15. St. Kitts and Nevis

Tax rate: Zero to five percent

In terms of choosing a location that provides a direct and simple path to cheap taxes and second citizenship, St. Kitts and Nevis has established itself as the best option. St. Kitts and Nevis has one of the best tax benefits among nations that provide citizenship by investment programmes. Only income derived locally is subject to taxation under the government’s territorial taxation scheme. Additionally, there is a five percent flat tax on all income.

Businesses also benefit from advantageous tax treatment. The corporate income tax rate for businesses is a high 33 percent; but, by paying an annual licence fee, the rate can be lowered to one percent. Businesses with foreign partners can pay corporate income taxes at a much lower rate because to additional tax breaks.

16. Bahrain

Tax rate: Zero percent

In the Persian Gulf, next to its neighbours Qatar and the United Arab Emirates, is the Kingdom of Bahrain. More significantly, it enjoys tax-free status for income, sales, capital gains, corporations, and estates with the exception of earnings derived from the nation’s fossil fuels. The tax rate for businesses doing this course is 46%, whether the net profits are domestic or international. Other than that, Bahrain is one of the most well-liked places to live when it comes to minimising taxes.

Bahrain is one of the most liberal Gulf States in the world, and its residents are hospitable and proud of their heritage, which is another appealing quality. Almost all Bahrainis are also proficient in English. The only significant drawback is the possibility of island fever among expats living on the island country. On Muharraq Island, beachside projects have begun to emerge for individuals wanting a little more of a lifestyle benefit.

Recommended: Differences Between Microeconomics And Macroeconomics

Conclusion

The findings might change depending on how you interpret them, just as with any statistics. Some of the nations on this list, like the United Arab Emirates, have no personal nor income taxes and generally low taxes. Others may have high individual tax rates, but their tax receipts as a share of their GDP may still be low, in part because of the size of their economies.

Edeh Samuel Chukwuemeka, ACMC, is a lawyer and a certified mediator/conciliator in Nigeria. He is also a developer with knowledge in various programming languages. Samuel is determined to leverage his skills in technology, SEO, and legal practice to revolutionize the legal profession worldwide by creating web and mobile applications that simplify legal research. Sam is also passionate about educating and providing valuable information to people.